Payment Gateway Integration Cost: Detailed Explanation

Suprabhat Sen | June 30, 2025 , 13 min read

Table Of Content

World economies are adopting fast payment systems, as the global economy is inclining towards cashless transactions.

A global payment preferences survey by DataPortal revealed that the countries like South Korea, Sweden, Russia, UK, France, China, Spain, Japan, US, India prefer cashless transactions via fast payment systems, with South Korea having 77% optimism, and whereas India having 52% as preferred choice.

In the Asia Pacific region, the magnitude of cashless transactions is expected to reach 1818 bn USD by 2030, from around 500 bn USD in 2020. This astonishing optimism for fast payment systems and ever expanding digitalisation reflects the stability of payment gateways. The existing infrastructure supports a variety of channels for instant settlement of cash.

With this, businesses aiming to expand their footprint, cannot miss out on integrating the digital footprint of fast payment systems. The commanding position payment gateways hold must be understood, and identify its place as a faster way to growth.

So, for businesses wanting to understand the budgeting of the payment gateways integration cost becomes vital.

In this blog, we will take on board the various components of these costs and highlight key factors that influence the cost of payment gateways integration for businesses of all sizes. Let us begin.

Estimating the total cost of integrating a payment gateway into a website depends on several factors, including the type of payment gateway, the complexity of the integration, and additional compliance or security needs. However, for most businesses, the following ranges provide a realistic idea:

| Cost Element | Estimated Range |

| Setup Fees | USD 25 – USD 250 |

| Development and Integration Costs | USD 100 – USD 1,000 |

| Monthly/Annual Maintenance Fees | USD 10 – USD 70 (recurring) |

| Compliance and Security Enhancements | USD 100 – USD 500 (optional, depending on standards like PCI-DSS) |

| Additional Features and Upgrades | USD 50 – USD 500 (for subscription billing, fraud detection, multi-currency support, etc.) |

Overall Estimate:

The average upfront cost of integrating a payment gateway typically ranges from around USD 200 to USD 1,500, depending on the gateway choice and the level of customization required.

Ongoing costs such as transaction fees (1.5% to 3.5% per transaction) and monthly service fees (starting from USD 10) should also be factored into your budgeting for long-term financial planning.

Small businesses looking for a simple, plug-and-play hosted payment gateway can expect to spend on the lower end of this range.

Mid-sized or scaling businesses requiring API-based, custom integrations with additional features like recurring billing or multi-currency processing will likely see higher upfront investment.

Investing strategically at the beginning helps minimise unexpected upgrade costs later and ensures a smoother payment experience for customers.

How To Calculate Payment Gateway Integration Expenses?

Quickly estimate your payment gateway integration costs using our AI-enabled cost calculator.

When budgeting for a payment gateway, it’s important to look beyond just the transaction fee. Here are the key cost components you need to account for:

Setup Fees: $25 – $250 (one-time)

Development & Integration: $100 – $1,000

Testing/Sandbox Setup: May be included or billed separately

Transaction Fees: 1.5% – 3.5% per transaction

Monthly/Annual Maintenance Fees: $10 – $70

Add-On Features: $20 – $500/month

PCI-DSS Compliance: $100 – $500/year

Fraud Protection Tools: $50 – $500/month

Currency Conversion Fees: 1% – 3% per transaction

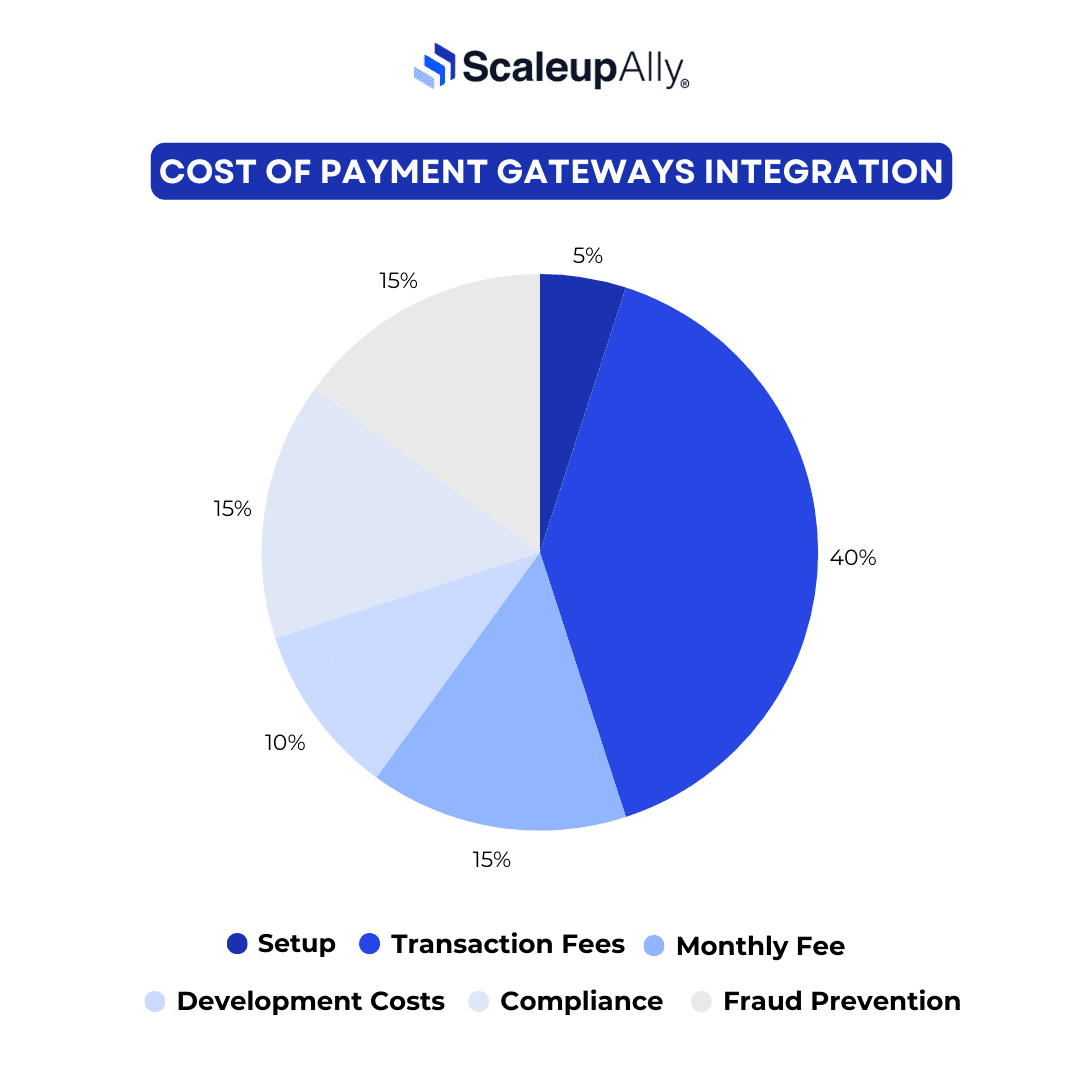

| Cost of Payment Gateways Integration | Percentage (%) |

|---|---|

| Setup Fee | 5 |

| Transaction Fees | 40 |

| Monthly Fee | 15 |

| Development Costs | 10 |

| Compliance | 15 |

| Fraud Prevention | 15 |

Payment Gateway Cost Optimisation: A Case Study

| Section | Details |

|---|---|

| The Challenge | E-commerce Startup in organic skincare faced shrinking profit margins due to high payment gateway fees. High transaction and monthly platform fees. |

| The Analysis | Analyzed transaction volume, average order value, and fee structure. Found high transaction fees impacting profits. Monthly fee offered little value. |

| The Solution | Switched to a new payment gateway with: 1. Lower transaction fees. 2. Tiered pricing model. 3. Better security and integration. |

| The Outcome | Reduced payment processing costs by 20%. Reinvested savings into marketing, product development, and customer acquisition. Improved profit margins and competitive pricing. |

| Key Learnings | 1. Analyze payment gateway fees for cost-saving opportunities. 2. Assess the long-term impact of fee structures. 3. Switch providers if a better option is available. |

The method you choose for integrating a payment gateway — whether a hosted solution or an API-based system — can significantly impact both upfront and ongoing costs.

Each integration approach offers distinct advantages, but they come with different financial implications.

| Hosted Gateways | API-Based Gateways |

|---|---|

| ✅ Quick setup, minimal coding | ⚙️ Requires developer effort |

| 💰 Lower setup cost ($100–$300) | 💵 Higher setup cost ($500–$1,500) |

| 🔐 Compliance handled by provider | 🔒 You manage compliance |

| 🔄 Redirects user to external page | 🛒 Fully embedded checkout |

| 💳 Higher per-transaction fees | 💳 Lower fees for high volume |

| 🎨 Limited customization | 🧩 Full design flexibility |

Hosted payment gateways redirect customers to an external platform to complete their transactions. Examples include PayPal, Razorpay, and Stripe Checkout.

Cost Considerations:

Hosted gateways are ideal for businesses seeking a quick launch with minimal technical effort but are willing to trade off some flexibility and absorb slightly higher long-term transaction costs.

API-based gateways integrate payment processing directly into a business’s website or app, offering full control over the payment flow. Examples include Stripe API, Authorize.Net, and Adyen.

Cost Considerations:

API-based integration is a smart choice for businesses expecting significant growth, needing brand control, or aiming to optimize margins as transaction volumes increase.

Small Tip:

Businesses planning to scale quickly should carefully evaluate whether investing slightly more in API integration upfront could lead to greater long-term savings and a superior customer experience.

The cost of the payment gateway integration also varies according to the size of the business and the volume of transactions it does. Some of the larger businesses that process more transactions get to negotiate for lower transaction costs and typically rely on expert integration services to ensure systems scale efficiently with growth.

However, small businesses or start-ups may be charged with higher fees due to the fact that they transact fewer volumes than the large business. Some of the payment gateways offer price packaging systems; this means that as the number of transactions increases the price per transaction reduces.

For example, a business that does an annual turnover of $1,000,000 in business may be levied 2.5 % per transaction while one processing $10 million may be charged only 1.5% due to the fact that the amount of purchase that qualifies for this offer attracts a higher discount.

There are different types of payment gateways, each affecting costs differently:

The cost of the payment gateway integration also depends on geographical location and market factors. These charges can be further differentiated by locality and competition within the area.

For example, payment gateways in the countries with stricter regulatory and security standards are likely to incur higher compliance expenses, which will be recovered from the businesses.

Also, the payment gateways may offer different fees depending on the currency to be processed. A gateway that is operating in the U. S. might have a different fee structure from that operating in Europe or Asia.

For instance, handling payment in different currencies may attract other charges such as currency exchange rate charges which may be between 1% and 3% of the cost of the transaction.

While the initial setup and integration costs are vital considerations, businesses must also account for the long-term costs associated with upgrading and expanding their payment gateway functionality.

As customer expectations evolve and new technologies emerge, businesses often need to add new features or enhance existing ones to remain competitive and compliant.

Some of the common upgrade and feature add-on costs include:

It’s essential for businesses to plan beyond just the initial integration and anticipate these evolving needs. Building flexibility into the initial choice of a payment gateway can prevent higher upgrade costs and operational disruptions down the line.

At ScaleupAlly, we offer you the most convenient and the most suitable payment gateway integration services for your business regardless of the scale and the level of advancement of your business enterprise.

All of our services are provided by a team of tech professionals, guaranteeing that your transition would be as premium as possible with no technical issues to worry about! Our support team is always on standby to help you get the best out of your payment gateway.

| Support Feature | What We Do for You |

|---|---|

| Personalized Consultation | - We start with a one-on-one consultation to understand your specific needs. - Our experts help you choose the best payment gateway solution for your business. |

| Initial Needs Assessment | - Expert integration of the payment gateway into your existing systems and platforms. - Handling of API connections, backend setup, and system compatibility checks to ensure seamless operation. |

| End to End Integration Assistance | - Our tech team takes care of integrating the payment gateway with your existing systems. - We handle all the technical details to ensure a smooth setup with minimal disruption. |

| Ongoing Technical Support | - Have questions or run into issues? We’re here for you with prompt and friendly support. - Our team provides assistance throughout the integration process and beyond. |

| Troubleshooting and Problem Resolution | - We don’t just set up and leave; we help optimize your payment system for peak performance. - Regular check-ins and updates to ensure your gateway is working efficiently. |

| Real-Time Monitoring and Alerts | - Continuous monitoring of your payment gateway to detect and address issues proactively. - Instant alerts to keep you informed of any potential problems. |

With a proven track record of delivering custom payment gateway solutions, we’ve helped countless businesses boost sales, better customer satisfaction, and future-proof their operations.

Innovation is at the heart of our company and therefore, we always ensure that we are on the lookout for the latest payment technology, to keep you stay ahead of the curve. Call ScaleupAlly now and schedule your free consultation meeting and we will help you decide on the best payment solution for your business.

Understanding the various factors influencing the cost of adding payment gateway to website is crucial for businesses aiming for seamless online transactions. The traction payment gateways are gaining for businesses that are expanding and scaling, it is mostly because of the ease of doing business the interface offers. It provides end to end transaction faculty. The secure connection between the source and terminal point gives it the backbone.

As once quoted by Doug Ludlow, Co-Founder and CEO of MainStreet, “We’re watching financial power shift from enormous, global institutions to individuals.” This aptly summarizes the importance of payment gateways to be integrated by businesses for their strategic models in today’s time.

Q: How much does it cost to set up a payment gateway?

The cost to set up a payment gateway starts from USD 100 to USD 1000. This may go up depending on the complexities of the system and compliances.

Q: Are there any hidden fees associated with payment gateway integration?

There aren’t any hidden fees associated with payment gateway integration, but fees like chargeback fees, cross border fees, refund processing fees, inactivity fees, PCI compliance fees, etc might be charged for operational reasons.

Related Blogs

Code Snippets

Wondering how much payment gateway integration actually costs? Discover the key factors that influence pricing, from setup fees to transaction costs and more.

webadmin

Feb 13 ,

7 min read

15 Best Payment Gateways in the UAE in 2025 [Latest Updated]

Discover the top 15 payment gateway options in the UAE, including features, and pricing plans for businesses seeking secure online transactions.

Suprabhat Sen

Nov 25 ,

13 min read

Top 13 Mobile Payment Gateway Solutions [2025]

Discover the top 13 mobile payment gateways, with key features, pros, cons, and integration tips to help you choose the best solution for your app.

Suprabhat Sen

Nov 8 ,

18 min read