Financial Software Development: A Comprehensive Guide

Suprabhat Sen | December 24, 2024 , 15 min read

Table Of Content

Every transaction successfully carried out is done with the aid of financial software. Yet as we find our way into 2025, the financial software ecosystem is evolving at an unprecedented pace calling on us to be innovative. We must rethink how people interact with their money by making financial software intuitive, accessible, and as human as possible.

For that matter, we dive into the future of fintech in this blog with a fresh perspective on what financial software development is.

Key Takeaways

- You must create financial software that’s secure and user-friendly and adapts to the evolving needs of businesses.

- Cutting-edge technologies such as AI, blockchain, and cloud computing are reshaping the future of financial software by making it smarter, faster, and more secure than ever.

- To deliver dependable financial software, it’s essential to prioritize real-time data processing, scalability, and robust security measures, all while designing an intuitive and seamless experience for users.

- While development costs may vary, custom financial software offers flexibility and functionality that empower businesses to thrive in a competitive market.

What is Financial Software Development?

- What is Financial Software Development?

- Why Do Businesses Need Custom Financial Software?

- Types of Financial Software

- 5 Key Features of Financial Software

- Technologies Used to Build High Performing Financial Software

- 7 Steps to Develop Financial Software

- How Much Does It Cost to Build Financial Software?

- Challenges in Financial Software Development

- How Can ScaleupAlly Help?

- Conclusion

- Frequently Asked Questions

Financial software development is the process of creating digital solutions to handle financial-related challenges as basic as budgeting to complex trading systems for financial interactions to be more efficient and accessible. This could be through an app that reminds you of bill payment or the backend system that keeps a multinational bank running.

Why Do Businesses Need Custom Financial Software?

Off-the-shelf solutions rarely meet the needs of businesses and for that reason, there is the need to opt for a custom-made financial software. Here are a few more reasons:

1. It Solves Unique Challenges Faced by Businesses

No two businesses are alike, and their financial workflows reflect this uniqueness. The thing about custom or bespoke software is that it doesn’t force a business into a generic mold. Instead, it’s built to handle specific processes.

We see these differences in for example a startup disrupting the gig economy that might need to manage real-time payments for freelancers globally. While a traditional retail chain on the other hand may focus on inventory cost tracking. Custom software helps businesses operate exactly as they intend by addressing these needs without compromises.

2. Security

Security in financial systems isn’t optional but fundamental. Recently, the Ugandan Central Bank announced that hackers made way with about US$16 Million from some accounts.

Businesses wanting to avoid this from happening to them must avoid pre-packaged solutions which often carry vulnerabilities due to widespread usage and predictable structures and go in for custom financial software which allows for built-in, business-specific security protocols that can include advanced fraud detection algorithms, bespoke encryption, or unique access hierarchies.

Custom security measures offer a peace of mind that is invaluable for businesses dealing with sensitive data or high-value transactions.

3. Room for Growth

Ways by which businesses evolve may include expanding their market reach, introducing new services, or scaling operations. And with this growth, custom financial software grows along. Instead of patching new features onto outdated systems, companies can extend their custom-built tools.Think of it as a foundation designed to support upward expansion without cracks appearing later.

For example, a company handling regional sales today may later need multi-currency support for global trade. This growth change should also evolve in custom financial software without upheaval.

4. Ownership and Autonomy

Using off-the-shelf software often means giving up control because you will have to rely on vendors for updates, support, and sometimes even access to your data. Custom solutions shift the balance of power by enabling the business to retain full control over the software and dictate how it evolves and also ensure that sensitive data is handled internally without third-party oversight.

Types of Financial Software

Even though each financial software type serves a specific purpose, all share the goal of simplifying and enhancing financial operations. Here’s a look at some of the most impactful categories and their distinct advantages.

1. Personal Finance Management Tools

These management tools (Mint or YNAB) help users categorize transactions, budget, and monitor long-term goals. But beyond simplicity, the best of these tools integrate predictive insights and show how small changes like cutting back on takeout can impact savings over time. With costs rising, they give individuals a much-needed sense of control over their finances.

2. Advanced Accounting Platforms

Modern accounting software like Xero or Wave takes the stress out by automating tasks like invoicing, tax calculations, and payroll. What makes these tools indispensable is their adaptability in serving a one-person start-up just as effectively as a multinational enterprise. Some platforms even offer AI-powered forecasting to help businesses notice trends or risks before they manifest.

3. Enterprise Resource Planning (ERP)

ERP systems integrate financial data with supply chain logistics, HR processes, and customer interactions into a single ecosystem to centralize data and make it actionable. Tools like SAP or Oracle give executives real-time insights into operational performance to help them pivot quickly when market conditions change.

4. Investment Optimization Software

Investors (individuals or firms) need tools to manage their portfolios. Investment software like eToro or Bloomberg Terminal combines live market data, performance tracking, and analytics to maximize returns. What sets these platforms apart today is their growing use of AI to help users make smarter decisions by analyzing thousands of data points in milliseconds.

5. Payment Systems and Gateways

Every tap of a credit card or click of a “Pay Now” button relies on payment processing software. Stripe, PayPal, and Razorpay ensure these transactions are smooth, secure, and lightning-fast. Businesses can customize these tools to meet subscription-based billing or real-time fraud monitoring needs. As global commerce grows, these systems are becoming the invisible backbone of economic exchange.

Also Read: 5 Cheapest eCommerce Payment Gateways

6. Tax Compliance and Filing Software

The tax season doesn’t have to mean that you must stay awake late into the night working with spreadsheets when tools like TurboTax or Zoho Tax can automate filing and calculating deductions for you. An even more impressive feature is their ability to integrate with broader financial systems for businesses with complex reporting needs.

7. Analytics and Financial Insights Platforms

Numbers don’t really mean much when we talk about data. Instead, insights are important in such situations and by doing so, financial analytics software like Tableau or Power BI transforms raw data into meaningful dashboards and visualizations to help businesses determine inefficiencies, forecast budgets, or even predict cash flow shortfalls, enabling them to view their financial futures.

5 Key Features of Financial Software

Here are 5 must-have features of a high performing financial software:

1. Security That Leaves No Room for Worry

Money and trust go hand in hand and financial software needs to protect both. We are not talking about encrypting data (though that’s a given), rather, we are referring to layered security like multi-factor authentication, real-time fraud alerts, and systems that adapt to threats. Airtight security isn’t optional; it’s expected.

2. An Interface You Don’t Need a Manual For

No one likes clunky software, so financial tools should feel natural to use even for someone who’s not tech-savvy. Simple layouts, intuitive menus, and clear instructions will make the software workflows smoother. You need to think about saving time and sparing frustration because your software should work for you, not the other way around.

3. Real-Time Updates That Keep You in the Loop

In finance, one must always stay updated at all times when it concerns payment hitting your account or market data shifting in the blink of an eye. Real-time processing ensures you’re never left guessing and makes it easier to act fast, avoid mistakes, and stay ahead.

4. Insights That Actually Mean Something

Financial software should do more than spit out numbers—it should make sense of them. Customizable dashboards, detailed reports, and trend analysis tools help you see the big picture. And with predictive analytics becoming more common, you’re preparing for what’s coming.

5. Access Anywhere, Anytime

Life doesn’t happen behind a desk, and financial software shouldn’t either. Whether you’re checking balances on your phone or reviewing budgets on a tablet, being able to access your data wherever you are shouldn’t be a luxury but a necessity. Cross-platform compatibility keeps everything within reach, no matter where the day takes you.

Technologies Used to Build High Performing Financial Software

Some technologies used in building high-performing financial software are:

1. Blockchain for Transparency and Security

Blockchain isn’t reserved for cryptocurrencies only; it’s revolutionizing how financial transactions are recorded and verified. By creating immutable, decentralized ledgers, blockchain ensures transparency and minimizes fraud. For financial software, this technology is critical in enabling secure peer-to-peer payments, smart contracts, and even tamper-proof auditing processes.

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML have become the backbone of predictive analytics in financial software in detecting fraud, identifying anomalies in real time, and robo-advising investors to make data-driven decisions. These technologies bring intelligence and efficiency. AI also enhances customer service with chatbots that handle queries instantly and accurately.

3. Cloud Computing for Scalability

Cloud platforms like AWS, Azure, or Google Cloud provide the infrastructure needed for financial software to handle large-scale operations. By hosting systems on the cloud, companies benefit from improved scalability, faster processing speeds, and reduced downtime. Plus, cloud services allow seamless data sharing across platforms, enhancing collaboration.

4. Application Programming Interfaces (APIs)

APIs enable seamless integration with banking systems, payment gateways, and other software. For instance, open banking APIs allow financial apps to connect directly with user bank accounts, streamlining transactions and delivering real-time updates.

5. Big Data and Analytics

Financial software generates massive amounts of data, and big data technologies like Hadoop and Apache Spark are essential for processing it efficiently. These tools allow businesses to extract actionable insights, optimize risk management, and deliver personalized services. Predictive analytics, powered by big data, helps financial institutions anticipate market trends and customer behavior.

6. Cybersecurity Frameworks

Technologies like advanced firewalls, intrusion detection systems, and end-to-end encryption ensure that financial software remains secure against threats. Tools like SIEM (Security Information and Event Management) platforms enable real-time monitoring and rapid response to potential breaches, a must-have for safeguarding sensitive financial data.

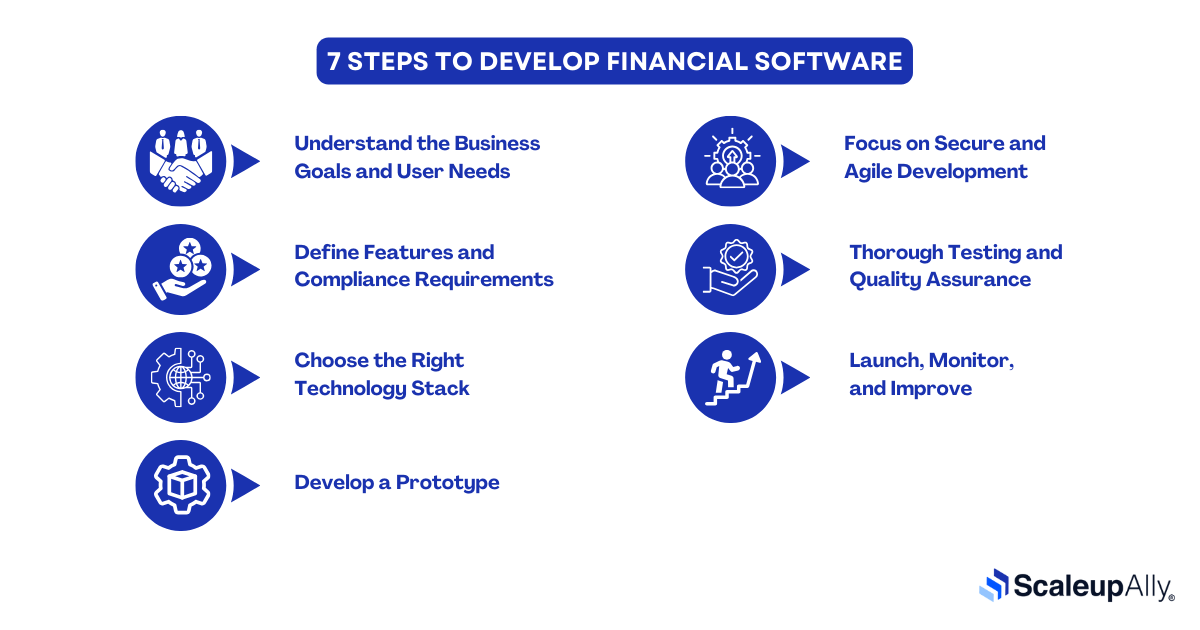

7 Steps to Develop Financial Software

Here are the steps involved in developing a financial software:

1. Understand the Business Goals and User Needs

Financial software begins with an exploration of its purpose (which is to manage personal budgets, streamline enterprise accounting, or enable secure digital payments). Conduct market research and stakeholder interviews to identify the pain points and expectations of end users. This step lays the foundation for a solution that’s both relevant and effective.

2. Define Features and Compliance Requirements

Financial software operates in a highly regulated space. Along with user-centric features, ensure the system aligns with relevant standards like GDPR, PCI DSS, or AML guidelines. For example, if you’re building payment software, multi-factor authentication and encryption aren’t optional but critical features. Create a detailed roadmap outlining both functional and compliance-related features.

3. Choose the Right Technology Stack

Your technology stack determines the performance, scalability, and security of the software. Select a backend language like Python for versatility or Java for its reliability in enterprise settings. Use secure frameworks like Spring Boot, and opt for cloud services like AWS or Azure to ensure scalability. Don’t forget to integrate APIs for seamless banking and payment connections.

4. Develop a Prototype

Start small with a prototype or MVP (Minimum Viable Product) to bring your ideas to life. This phase is about gathering feedback early. Show your prototype to key stakeholders or test groups, and use their insights to refine the software before diving into full-scale development.

5. Focus on Secure and Agile Development

Security is paramount in financial software so use techniques like secure coding, regular vulnerability testing, and penetration tests to safeguard against breaches. Pair this with agile development practices to ensure continuous improvement and flexibility. Divide development into sprints, prioritize tasks, and maintain regular feedback loops to keep the process dynamic and aligned with user needs.

6. Thorough Testing and Quality Assurance

Financial software leaves no room for errors. Test rigorously across all aspects (functionality, usability, performance, and security). Conduct stress tests to ensure the system can handle high transaction volumes without glitches by testing compatibility across devices, browsers, and operating systems to provide a seamless user experience.

7. Launch, Monitor, and Improve

Once your software is live, the work doesn’t stop there. You should implement monitoring tools to track performance, identify issues, and collect user feedback. Regular updates and security patches keep the software relevant and resilient in the face of evolving threats so that should be part of the list too. Use analytics to measure success against KPIs and look for opportunities to add new features or improve existing ones.

How Much Does It Cost to Build Financial Software?

The cost of building financial software depends on its features. Below is a table outlining approximate costs based on the type of application, along with reference examples.

| Type of Application | Cost Estimate | Reference Application |

|---|---|---|

| Personal Finance Software | $20,000 - $50,000 | Mint, YNAB |

| Accounting Software | $50,000 - $150,000 | QuickBooks, FreshBooks |

| Enterprise Resource Planning | $200,000 - $500,000+ | SAP, Oracle ERP |

| Investment Management Tools | $100,000 - $300,000 | Bloomberg Terminal, Robinhood |

| Payment Processing Software | $50,000 - $200,000 | PayPal, Stripe |

| Tax Preparation Software | $30,000 - $100,000 | TurboTax, H&R Block |

| Blockchain-Based Platforms | $150,000 - $400,000+ | Ethereum, Binance Smart Chain |

| Mobile Banking Applications | $100,000 - $250,000 | Revolut, Monzo |

| Risk Management Software | $100,000 - $300,000 | MetricStream, Resolver |

| Custom Financial Software | $50,000 - $500,000+ | Built for specific business needs |

Challenges in Financial Software Development

Developing financial software means solving problems in a space where trust, speed, and accuracy are everything. Let’s talk about the real challenges that make this job as rewarding as it is tough.

1. Security

Money is a magnet for trouble, and hackers know this better than anyone. Financial software has to stay ten steps ahead of every cyber threat be it phishing schemes, ransomware attacks, or fraud attempts by creating an impenetrable system without slowing users down. And that’s no small feat.

2. Playing by the Rules (Which Keep Changing)

The financial world runs on regulations and there are lots of them (GDPR, PCI DSS, anti-money laundering laws, etc) and developers need to ensure compliance from day one. The challenge however is that these rules aren’t static. They evolve, sometimes overnight, and the software has to keep up without breaking or losing user trust.

3. Handling the Weight of the World

Think about the stress levels on a payment gateway during Black Friday or a trading app on the day of a market crash. Financial software needs to handle insane loads without crashing. Performance is survival. Ensuring systems can process millions of transactions in real time, without glitches, is where the rubber meets the road.

4. The Legacy System Dilemma

Banks and financial institutions often rely on outdated legacy systems. Merging these with modern financial software can feel like connecting a steam engine to a bullet train. Data has to flow seamlessly between the two, and any hiccup can cause delays—or worse, errors.

5. Real-Time Processing: No Room for Lag

In the financial world, even a second’s delay can cost millions. Real-time data isn’t optional even if it is processing payments or updating investment portfolios. Ensuring this happens without hiccups, especially when networks or servers falter, is a constant uphill battle.

6. Perfection in Numbers

A single error in calculations or reporting can spiral into massive losses or lawsuits. Financial software doesn’t get a margin for error. Every formula, transaction, and report has to be flawless, which makes testing and validation a gruelling but essential process.

7. Everywhere, Every Time

People expect financial software to work perfectly across all their devices whether they’re checking balances on their phones or reviewing reports on desktops. Developing software that’s fast, responsive, and consistent across platforms is a challenge that keeps developers on their toes.

How Can ScaleupAlly Help?

Do you need financial software that doesn’t flinch under heavy load or tools that simplify the complexity without cutting corners? We’ve got you. Our software development services integrate emerging technologies like AI and build systems that grow with you and make scaling feel less like a gamble and more like a strategy.

We are here to make your business thrive in ways you didn’t think were possible. So, when you’re ready to scale smarter, not harder, contact us to make it happen with our BFSI IT services and solutions.

Conclusion

Custom financial software development is our contribution to shaping the backbone of tomorrow’s economy. Every feature, and every decision, carries the weight of trust, innovation, and security and as the financial world evolves, so must the software driving it.

To be a forerunner in this, you need an ally in helping you lead your industry. ScaleupAlly is your best bet.

Frequently Asked Questions

Q: What is a financial software system?

A financial software system is a digital platform designed to manage financial processes, such as transactions, budgeting, analytics, and compliance.

Q: How long does it take to develop financial software?

The time to develop financial software depends on complexity, features, and team size. Developing basic software might take 4-6 months, while complex, enterprise-grade solutions could take 12 months or longer.

Q: How to choose a financial software development company?

Look for companies with proven expertise in fintech, strong portfolios, and positive client reviews. Assess their ability to meet your specific requirements, their approach to security, and their readiness to provide post-launch support.

References:

Related Blogs

Top 20 Emerging Technologies of 2026

Discover the top 20 emerging technologies of 2026. Explore which innovations are driving change across healthcare, finance, manufacturing, and other crucial industries.

ScaleupAlly Team

Dec 16 ,

9 min read

Software Development Timeline: Phases, Duration & Estimation Guide

Understand the software development timeline with phase durations, key factors, hidden delays, and practical methods to estimate project time.

Suprabhat Sen

Nov 29 ,

16 min read

Software Development Cost Estimation Guide: What’s Included & What Affects the Price

Explore software development cost components, major pricing factors, and practical estimation methods to plan your project accurately from start to finish.

Suprabhat Sen

Nov 29 ,

14 min read