Gambling Statistics in the Philippines

According to the Philippine Amusement and Gaming Corporation (PAGCOR), the country’s regulatory body for gambling activities, the industry contributes significantly to the economy. Here are some statistics related to gambling in the Philippines.

1. Revenue growth

The gambling industry in the Philippines is flourishing, as per the latest statistics. It is predicted that the gross gaming revenue of the industry will double by 2028 and reach 450 billion to 500 billion pesos in five years. The sector is expected to witness at least 10% annual growth in gross gaming revenue, and this year, it is projected to achieve a record high.

2. Contribution to the economy

In 2019, the gambling industry in the Philippines generated Php 205.52 billion, demonstrating its significant economic impact.

3. Online gambling

The TGM survey found that 38.9% of people in the Philippines bet on sports in the last 12 months. Among them, 20.8% placed bets online or through apps while attending sporting events.

Key Growth drivers

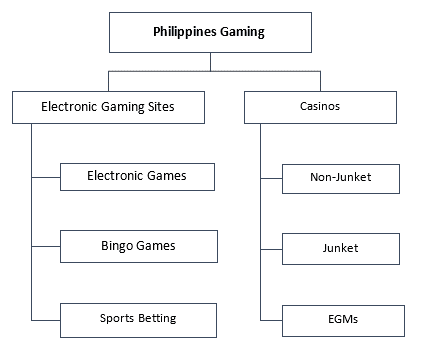

The Gambling Industry in Philippines has made impressive growth since 2008. Following are the key growth drivers fueling the industry:

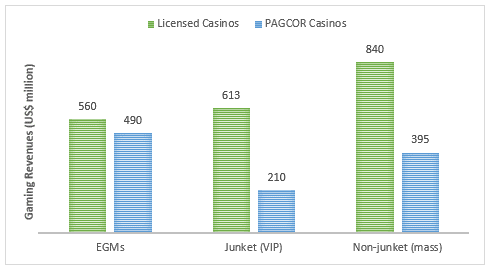

- Growth in VIP segments: The junket-sourced VIP segments account for one-third of the gaming revenues of private casinos. In addition, the VIP segments come mainly from proxy betting (illegal in the rest of Asia). In this, a person from outside the casino gives betting instructions to an agent inside. These gamblers do not play among the mass-market clients.

- Solid Domestic Market: The Philippines has a larger domestic market, especially in the non-junket segment. This is because its population is almost three times that of the combined population of Singapore, Malaysia, and Macau.

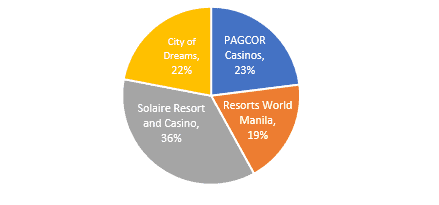

- Opening up of PAGCOR: Significantly, the Philippine gambling market was open to the world in 2008 when PAGCOR lost its monopoly to run its own casinos.

- Dominant foreign gamblers: The Koreans and Chinese form the majority of foreign gamblers in the Philippines.

- Exemption of Philippine from AML till 2017: In August 2017, casinos and junket operators were added under the watch of the Anti-Money Laundering Council (AMLC). Till this time, Philippine casinos were a great place to launder money. This advantage ultimately brought a lot of gamblers to the country.