Seelfa

Digital Credit Book

BFSI

Cloud Services

4

Initial Traction

Introduction

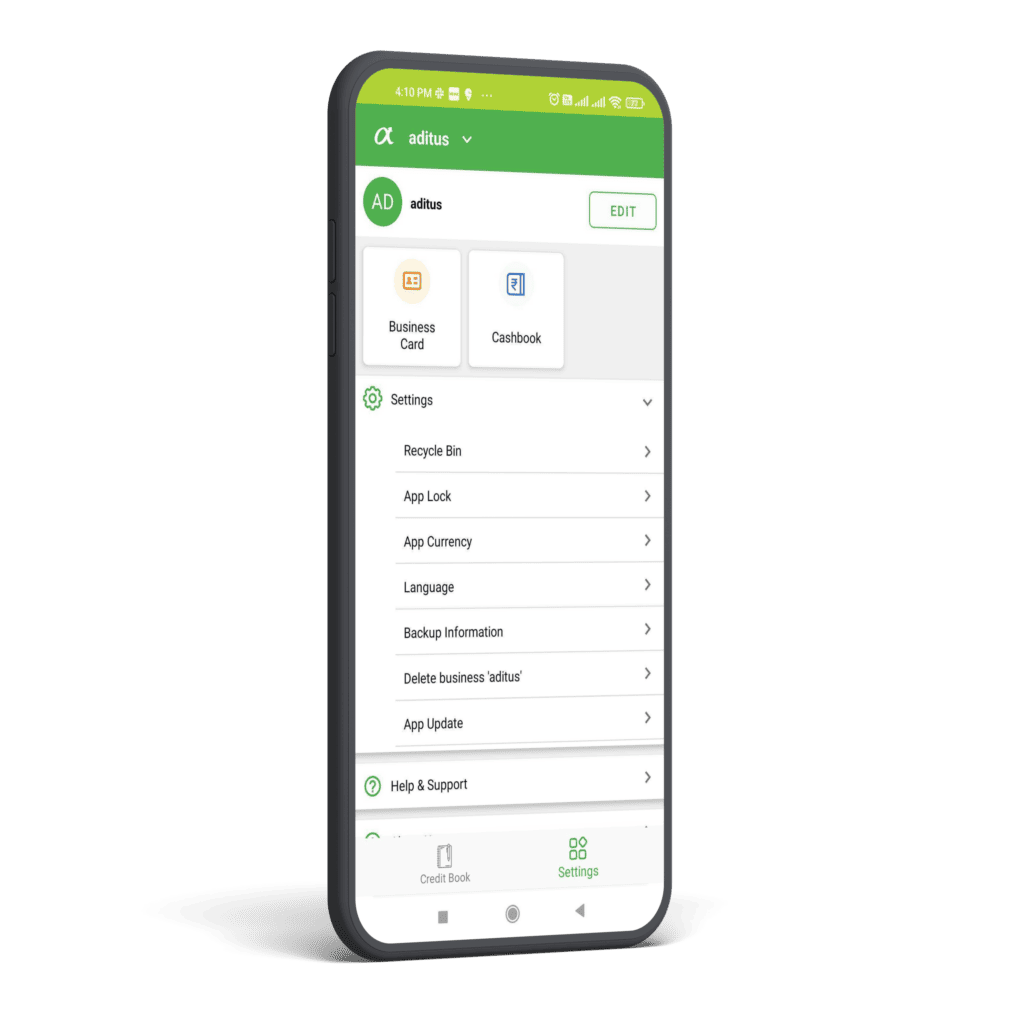

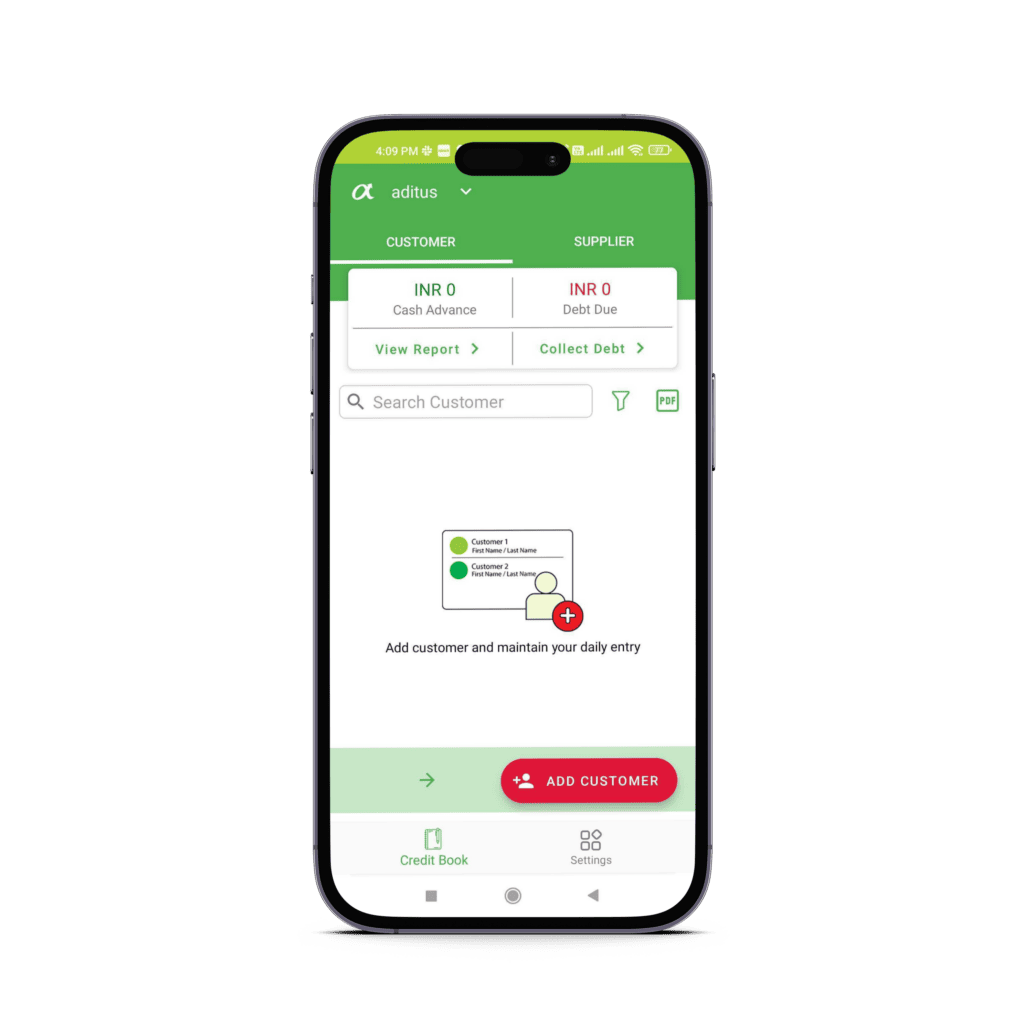

Seelfa is a credit book application developed by Harvard graduates to help small businesses around the world. The application provides a digital debt book and cash book to record transactions, send payment reminders, and receive payments from clients. To bring their vision to life, Seelfa partnered with ScaleupAlly, an app development company, to create a mobile app that caters to the specific needs of small business owners.

ScaleupAlly Team: The app development project was undertaken by the ScaleupAlly team consisting of four members with expertise in product strategy, App design, Android Developer, and project manager.

The project took four months to complete, from ideation and planning to deployment.

Methodology and Solution

The ScaleupAlly team followed an end-to-end development approach, which included product strategy, design, development, testing, and deployment. The team collaborated closely with Seelfa to understand their requirements, goals, and target audience. ScaleupAlly developed the application from scratch, managing the concepts of payments in marketplace scenarios, and ensuring that the app is user-friendly, accessible, and secure.

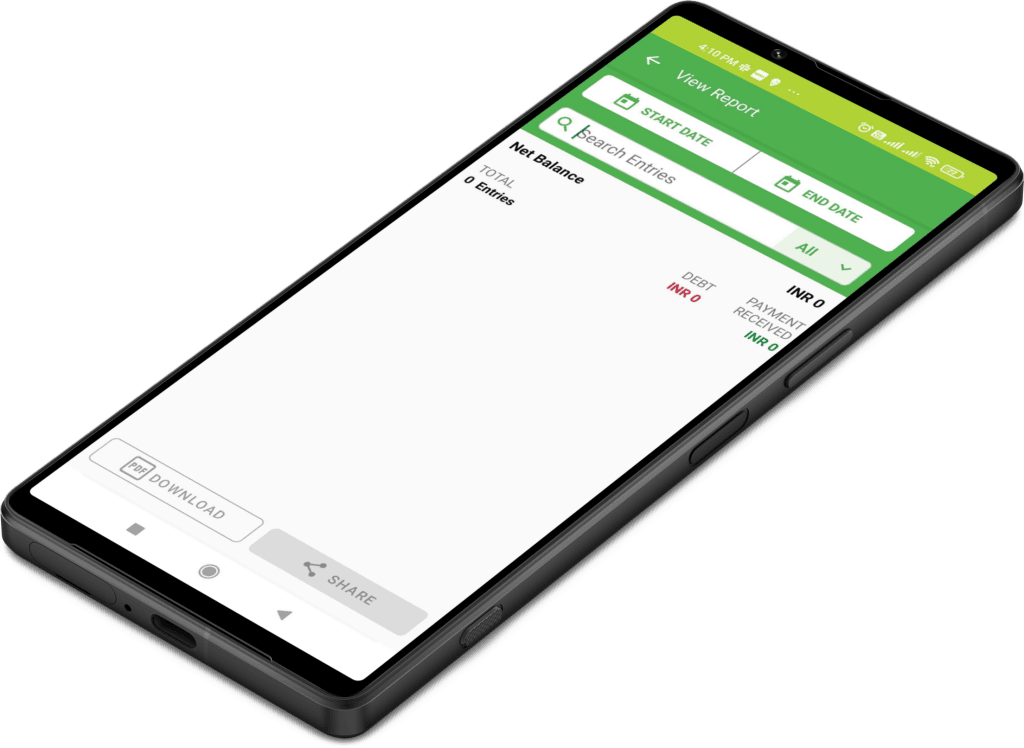

The application has been a success, with more than 100,000 downloads on the Play Store. Seelfa’s users can easily create and manage their digital debt and cash book, record transactions, send payment reminders, and receive payments from their clients. The ScaleupAlly team also integrated Stripe, a popular payment gateway, to facilitate secure and transparent payment transactions.

Tech Used: The ScaleupAlly team used Node.js for the backend, JavaScript and jQuery for the frontend, and Android Native for mobile development. The team also used AWS EC2 & RDS, CloudFront, and Webflow for hosting and deployment.

Results

Seelfa, a credit book application to help small businesses around the world, partnered with ScaleupAlly to create a mobile app that caters to the specific needs of small business owners. The ScaleupAlly team, consisting of four members with expertise in product strategy, App design, Android Developer, and project management, followed an end-to-end development approach, which included product strategy, design, development, testing, and deployment. Seelfa’s users can easily create and manage their digital debt and cash book, record transactions, send payment reminders, and receive payments from their clients. ScaleupAlly’s use of modern tech stacks and a user-centered design approach has resulted in a seamless and accessible app that caters to the specific needs of small business owners.

Founded in

Turnover

Clients

100+ thsd

Conclusion

The Seelfa credit book application developed by ScaleupAlly has helped small businesses around the world manage their finances more efficiently and effectively. The app has received positive feedback from users, with many praising its ease of use, accessibility, and security. ScaleupAlly’s use of modern tech stacks and a user-centered design approach has resulted in a seamless and accessible app that caters to the specific needs of small business owners.