Bourke Group

Empowering Bourke Group with Real time Profit and Loss Statements

Financial

Power BI Reports

6

Starting up & Scaling up

Introduction

Bourke Group is an Australia-based small regional firm founded in 1993 in Cobram, Victoria. With a focus on financial advisory services, including Wealth Management, Accounting, Tax, Corporate Advisory, and a market-leading virtual CFO service, Bourke Group has successfully helped numerous clients build, scale, and exit profitable businesses. They pride themselves on balancing financial success with managing personal and family implications during major events.

Business Objective

Business Use Cases:

- Real-Time Portfolio Monitoring: Bourke Group may want to provide clients with the ability to monitor their investment portfolios in real time. Clients can access up-to-the-minute information on their holdings, performance, and asset allocation.

- Risk Assessment and Mitigation: The firm might aim to use data analytics to assess and mitigate investment risks. By analyzing historical market data and client portfolios, they can provide proactive risk management strategies.

- Tax Optimization: Bourke Group can leverage data analytics to optimize tax strategies for clients. This includes identifying tax-efficient investment opportunities and minimizing tax liabilities.

- Client Segmentation: To tailor financial advice effectively, the firm can segment clients based on various criteria such as risk tolerance, financial goals, and life stages. This enables customized advisory services.

- Performance Benchmarking: Bourke Group may want to compare the performance of client portfolios against relevant benchmarks. This helps clients gauge the effectiveness of their investments.

Project Scope

- The project aimed to streamline Bourke Group’s data processes, implement data analytics, and provide tailored reports. It included:

- Consolidating data from multiple sources into a cloud-based AWS database.

- Developing a BI Dashboard for in-depth insights.

- Creating individual BI accounts for each client and account director access control.

- Automating data refresh through scheduled refreshers.

- Comprehensive engagement model with a team of 4 specialists.

Data Collection and Integration

Data from various sources, including Xero, Excel, QuickBooks, Salesforce, etc., were integrated into a single source of truth using AWS RDS.

Key Performance Indicators (KPIs)

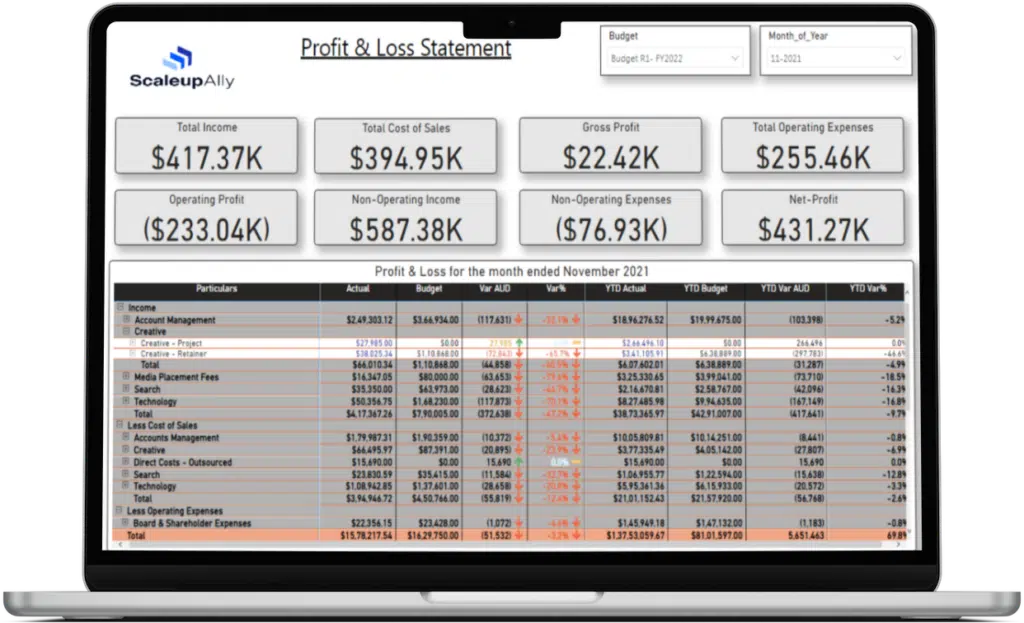

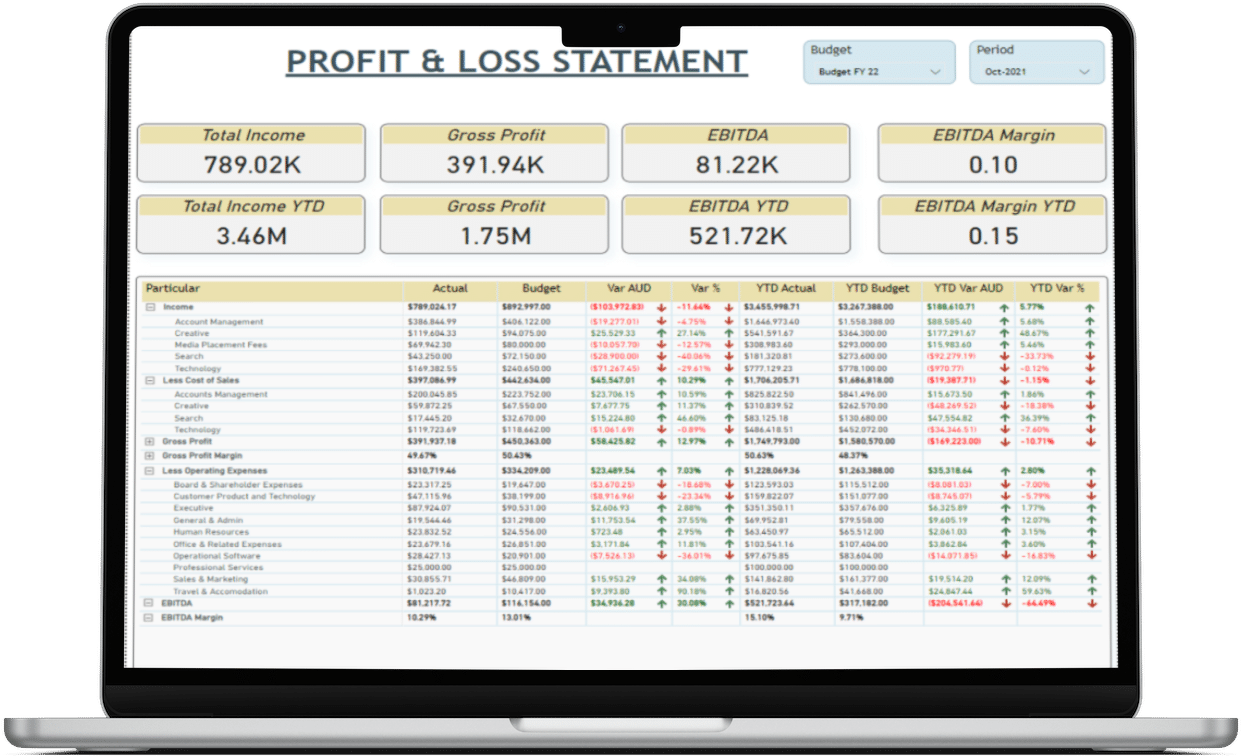

- Gross Profit

- EBITDA

- Income

- Cost of Sales

- Operating Expenses

- Budgeted Income

- Variance

BI Tools and Technologies

- Power BI: Data visualization tool for interactive dashboards.

- AWS RDS: Cloud-based server and database for data storage.

- Xero: Accounting tool for data retrieval.

- Microsoft Excel: Used for manual data updates.

- MySQL: Utilized for querying and data processing.

- Python: Implemented for API-related coding.

Data Analysis and Insights

- Three key dashboards were developed:

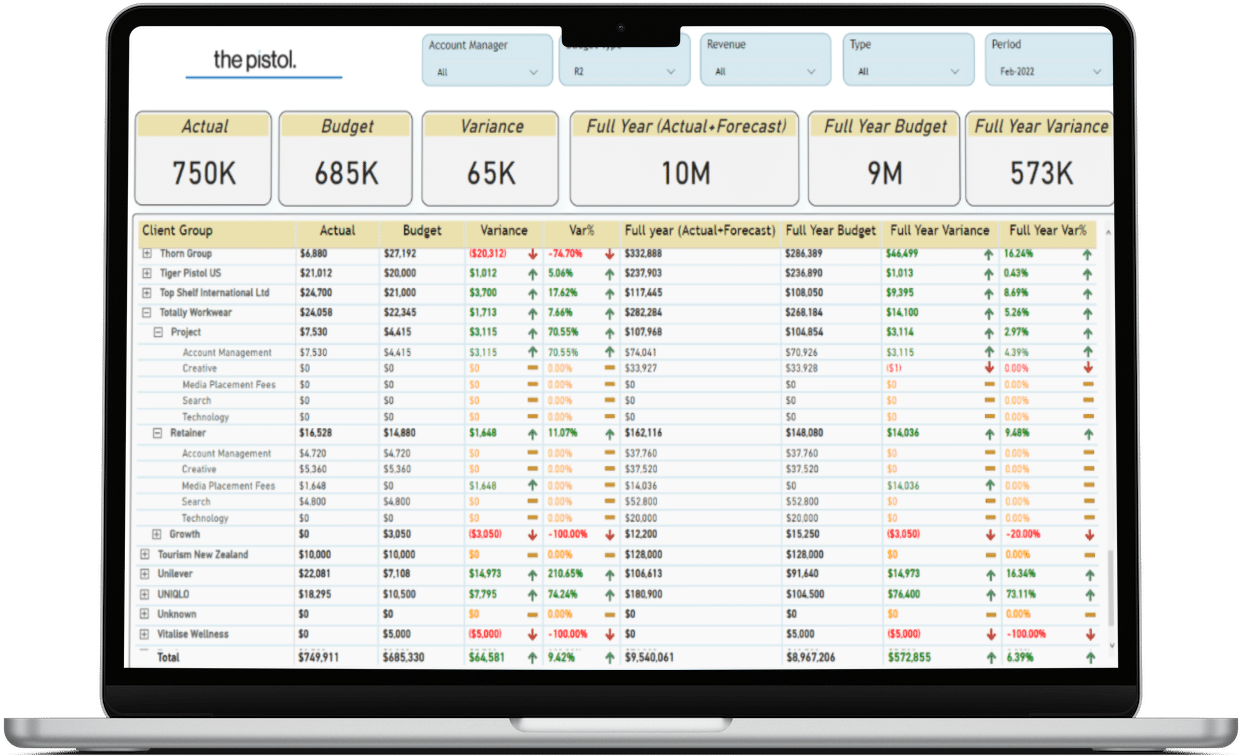

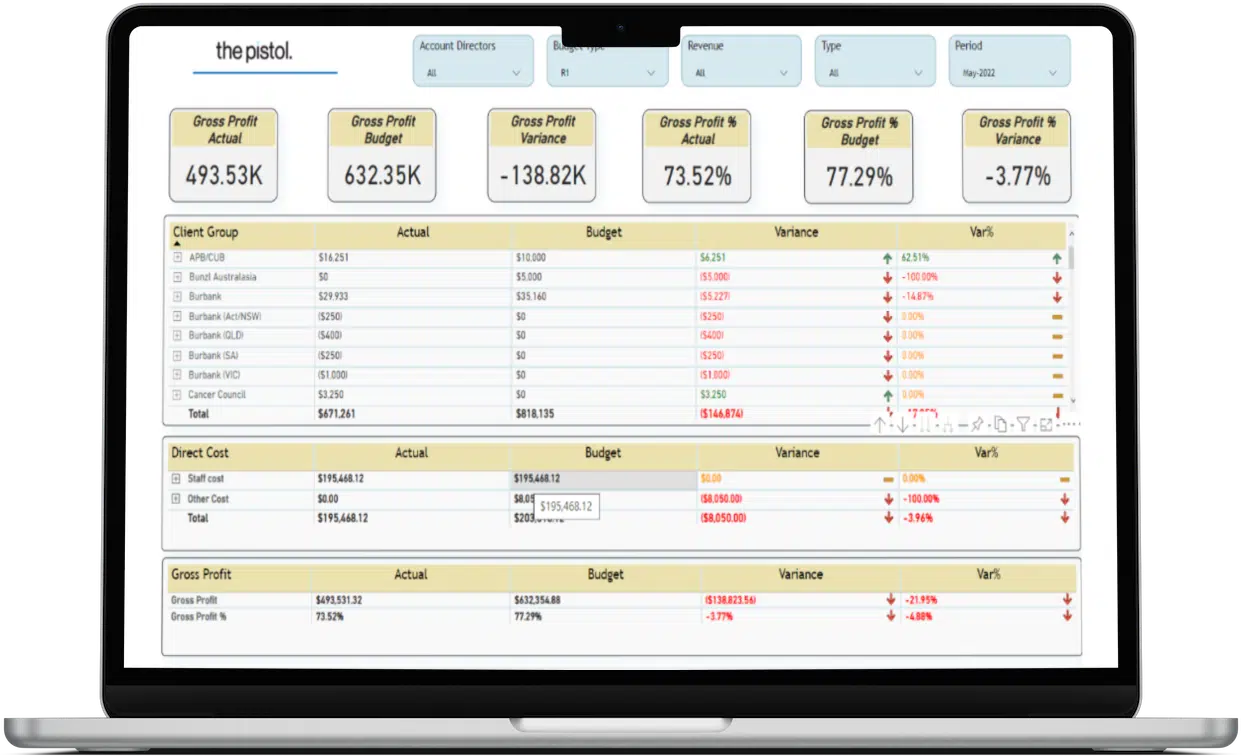

- Profit and Loss Statement Dashboard: Detailed PnL statement with major KPIs and YTD values, providing insights into income, cost of sales, gross profit, operating expenses, and EBITDA.

- Income Statement Dashboard (based on client groups): Detailed income statement showing actual income, budgeted income, variance, and more for each client.

- Account Directors Dashboard: Customized dashboard filtered for each account director, displaying data relevant to their client groups.

Challenges and Solutions:

Challenges:

- Scattered data from multiple sources.

- Lack of data analytics tools.

- Client-specific reporting required.

- Internal hierarchy access needed.

- Manual data refreshing process.

Solutions:

-

- Consolidated data into a single database using AWS RDS.

- Implemented Microsoft Power BI for data analytics and insights.

- Provided separate Power BI accounts for each client with tailored reports.

- Utilized Row-level Security in Power BI for account directors’ access control.

- Addressed data refresh challenge with automated schedulers.

Conclusion

The transformative power of Business Intelligence empowered Bourke Group to overcome data challenges and unlock unprecedented insights. By centralizing data and leveraging Power BI, Bourke Group achieved data-driven decision-making and tailored reporting for each client. The implementation of data refresh automation streamlined operations, ensuring up-to-date information. This BI solution positioned Bourke Group as a frontrunner in the financial advisory space, enabling them to guide clients on a path to sustained success.